SONA SUSTAINABILITY

CREDIT SCORE SYSTEM

‘Sustainability Insight: Redefining Investment Strategy’

Global Effect: Value Proposition

Our Impact

“As a global management consulting entity, we’re navigating heightened expectations for ESG transparency and performance enhancement. Partnering with Sona Analytics’ cutting-edge sustainability management platform exemplifies our commitment to harnessing innovative solutions for sustainable business practices.”

Anna Xinistery, General Manager, Kesea

“At our development finance institution, we’re committed to transforming lending practices. By leveraging Sona Analytics’ Sustainability Credit Score System, we’re empowering impactful investments that address climate change head-on, ensuring a sustainable future for all.”

Lawrence Obi, Head of Sustainable Lending, Bank of Industry

Solution: Making Businesses the Proponents of Societal Change

What we do

Sona Sustainability Credit Score System (SSCSS) is a simple, yet effective system for thousands of companies around the world to measure their Sustainability performance against a set of metrics, designed by world leading ESG, sustainability and climate research and development.

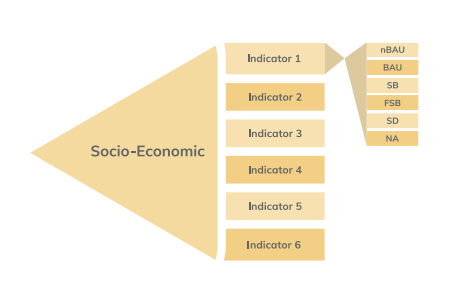

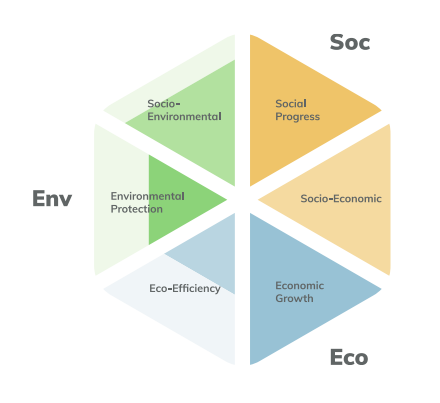

The SSCSS is composed of an online system of 30 questions developed from the analytical model in which six dimensions are present:

- Economic Growth

- Environmental protection

- Social progress

- Socio-economic development

- Eco-efficiency

- Socio-environmental development

Sustainability Analytics: Standardised Sustainability Metric

The Process

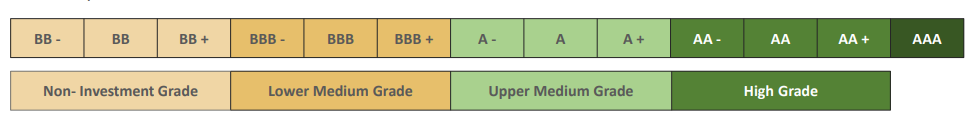

The Sona Sustainability Credit Score System (SSCSS) model is based on the analytic hierarchy process methodology which produces quantitative credit scores on sustainability that leads to improved and more responsible decision making.

o Select the relevant country, sector and industry of the company

o Research qualitative and quantitative sustainability performance

o Complete 5 indicators under each of the 6 dimensions present

o Generate, review and analyse the credit grade compatible results

o Measure and monitor Sustainability performance against other companies across sectors, industries and locations.

Cost-Effective Climate Mitigation

Banks and Financial Institutions

Banks and Funds wield significant influence over the types of businesses that receive funding, making them pivotal in addressing climate change. Adopting an investment approach that values and incentivizes environmental sustainability can drive widespread adoption among companies.

SSCSS benefits for Banks and Financial Institutions include:

- Unlocking capital to greener investments with favourable loan contracts, reduced interest rates and greater access to capital.

- Reducing reputational risk and potential fines for both lenders and businesses.

- Reducing information asymmetry between the company and its stakeholders.