Author: Rodrigo Zeidan

Date Published: 14/09/2017

Sustainable finance is not an oxymoron. Companies that invest in sustainability are more profitable, on average. That is the essence of the most recent article of the Center for Sustainable Business at NYU Stern, that was just published in the Harvard Business Review. I am one of the co-authors and you can read the entire article here.

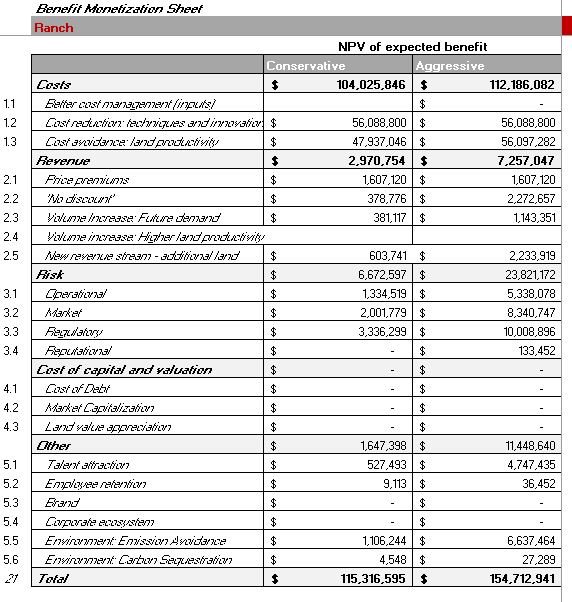

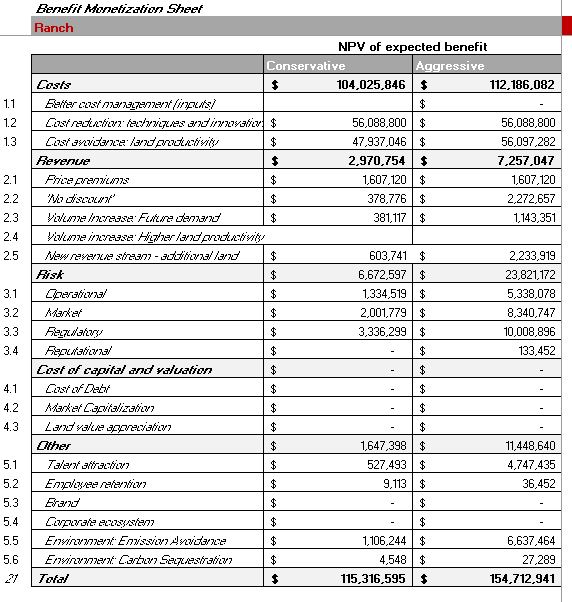

More importantly, we provide the the spreadsheets with all the data and assumptions that were used in the article.

We look at the beef industry supply-chain in Brazil. Our work has many counterparts in helping build the business case for sustainability. One example is the new work of Hartzmark and Sussman (2017), who show that higher sustainability is viewed as a positive predictor of future performance. What we bring to the table is moving from intangibles to praxis: the monetization methodology allows us to calculate the expected benefits of sustainability investments. As the article concludes:

The methodology and its application in this case study demonstrate that these financial improvements can be quantified and monetized in a credible and cost-effective manner, and have the potential to serve as a powerful tool with business decision makers.

Of course, the business case for sustainability, by itself, won’t be enough to stave off the myriad consequences of climate change and intensive economic active. We need better regulation and international cooperation alongside market mechanisms. But without businesses seeing the benefits from sustainability investments, everything will be harder. In our study, even under conservative assumption, improvements in operations related to environmental and social concerns would bring about USD 26 million of net present value to just one company, Marfrig. Smaller farmers would also benefit. Investments in environmental and social performance is more than just about the world’s survival. It is also profitable business.

The methodology and its application in this case study demonstrate that these financial improvements can be quantified and monetized in a credible and cost-effective manner, and have the potential to serve as a powerful tool with business decision makers.

Of course, the business case for sustainability, by itself, won’t be enough to stave off the myriad consequences of climate change and intensive economic active. We need better regulation and international cooperation alongside market mechanisms. But without businesses seeing the benefits from sustainability investments, everything will be harder. In our study, even under conservative assumption, improvements in operations related to environmental and social concerns would bring about USD 26 million of net present value to just one company, Marfrig. Smaller farmers would also benefit. Investments in environmental and social performance is more than just about the world’s survival. It is also profitable business.