Author: Rodrigo Zeidan

Date Published: 08/09/2015

Valuing a Sugar Manufacturer.

Some background on the company and its business model is warranted. The company produces white sugar in Brazil. It has seven year contracts with farmers who supply sugar cane. The firm is located in a frontier region in which the industry is expanding, with productivity that is lower than in the main producing regions in the country, but has been growing in the last few years at 1% a year. Property rights in Brazil are secure, and the company does not face major political and social risk (such as society revoking its license to operate). It has all legal permits and the region in which it operates is a frontier but legal area for farming sugar cane and establishing an industrial facility for sugar manufacturing. Today the firm produces 40,000,000 pounds of sugar a year, and is expanding towards 70,000,000 pounds in 5 years due to planned investments.

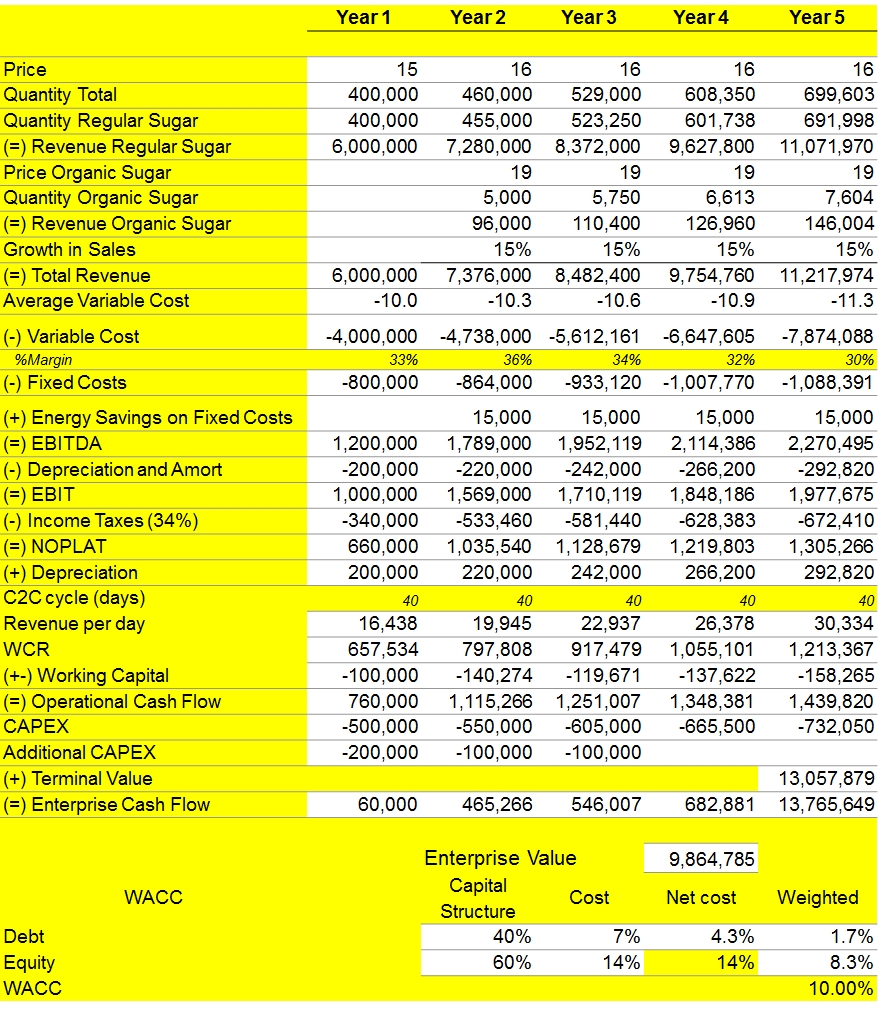

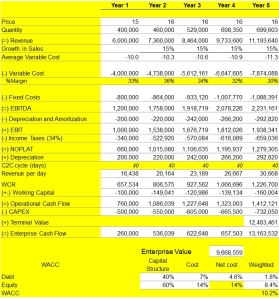

The assumptions for the valuation of the company are:

- The initial valuation period is 5 years, from 2015-2019.

- From 2019 on, values are going to be constant, which means a terminal value equal to the present value of a perpetuity based on (NOPAT less Working Capital and CAPEX) discounted by the weighted average cost of capital (WACC) of the company. NOPAT is operating profits net of taxes, and a broad measure of a firm’s cash flow to remunerate debt and equity holders. CAPEX is capital expenditures, or investments in expanding capacity. We also assume that the firm reinvests the amount of depreciation to renew its present capacity.

- Production is growing 15% a year, roughly, till 2019.

- Sugar prices are estimated to be US$ 0.15 per pound in 2015 and should be constant at US$ 0.16 per pound for the rest of the period. Data come from future contracts of sugar that are liquid till 2017.

- Variable costs are US$ 0.1 per pound in 2015 and grow by 3% a year during the 2015-2019 period (accounted for the growth in productivity).

- Fixed costs are US$ 800,000 in 2015 and grow at 10% a year. All values are inclusive of taxes.

- Capital expenditures are US$ 500,000 in 2015 and grow by 10% a year from 2015-2019.

- Investments in working capital are U$ 100,000 in 2015, and given a constant financial cycle of 40 days its values are, respectively, US$ 151,111 in 2016, US$ 122,667 in 2017, US$ 141,067 in 2018, and US$ 162,227 in 2019.

- We assume that from then on there is no change in operating profit.

- The firm does not need to spend on new investments, but its operating margin decreases by the same value as the CAPEX, for simplicity.

- Capital structure is composed of 40% of Debt and 60% of Equity, and assumed constant for the whole period.

- Cost of capital is also assumed constant, 7% a year for debt (due to subsidized credit for agricultural companies in Brazil) and 14% a year for equity.

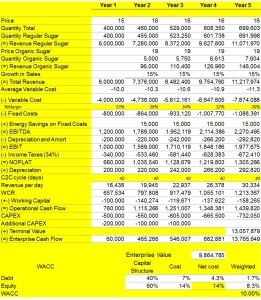

Cash-flows follow below. Enterprise value is US$ 9.67 million. You can fiddle with the Excel file to see the effect of changes in the assumptions.

Some background on the company and its business model is warranted. The company produces white sugar in Brazil. It has seven year contracts with farmers who supply sugar cane. The firm is located in a frontier region in which the industry is expanding, with productivity that is lower than in the main producing regions in the country, but has been growing in the last few years at 1% a year. Property rights in Brazil are secure, and the company does not face major political and social risk (such as society revoking its license to operate). It has all legal permits and the region in which it operates is a frontier but legal area for farming sugar cane and establishing an industrial facility for sugar manufacturing. Today the firm produces 40,000,000 pounds of sugar a year, and is expanding towards 70,000,000 pounds in 5 years due to planned investments.

The assumptions for the valuation of the company are:

- The initial valuation period is 5 years, from 2015-2019.

- From 2019 on, values are going to be constant, which means a terminal value equal to the present value of a perpetuity based on (NOPAT less Working Capital and CAPEX) discounted by the weighted average cost of capital (WACC) of the company. NOPAT is operating profits net of taxes, and a broad measure of a firm’s cash flow to remunerate debt and equity holders. CAPEX is capital expenditures, or investments in expanding capacity. We also assume that the firm reinvests the amount of depreciation to renew its present capacity.

- Production is growing 15% a year, roughly, till 2019.

- Sugar prices are estimated to be US$ 0.15 per pound in 2015 and should be constant at US$ 0.16 per pound for the rest of the period. Data come from future contracts of sugar that are liquid till 2017.

- Variable costs are US$ 0.1 per pound in 2015 and grow by 3% a year during the 2015-2019 period (accounted for the growth in productivity).

- Fixed costs are US$ 800,000 in 2015 and grow at 10% a year. All values are inclusive of taxes.

- Capital expenditures are US$ 500,000 in 2015 and grow by 10% a year from 2015-2019.

- Investments in working capital are U$ 100,000 in 2015, and given a constant financial cycle of 40 days its values are, respectively, US$ 151,111 in 2016, US$ 122,667 in 2017, US$ 141,067 in 2018, and US$ 162,227 in 2019.

- We assume that from then on there is no change in operating profit.

- The firm does not need to spend on new investments, but its operating margin decreases by the same value as the CAPEX, for simplicity.

- Capital structure is composed of 40% of Debt and 60% of Equity, and assumed constant for the whole period.

- Cost of capital is also assumed constant, 7% a year for debt (due to subsidized credit for agricultural companies in Brazil) and 14% a year for equity.

Cash-flows follow below. Enterprise value is US$ 9.67 million. You can fiddle with the Excel file to see the effect of changes in the assumptions.

This is a very simple valuation, with no bells and whistles (unleveraged vs. leveraged beta; industry-wide beta; regression-derived cost of equity, simulations of cash-flows volatility etc). Hypotheses are explicit but ad-hoc. Such assumptions are related to cost of equity and debt, among others. I am less interested in precision than in showing how to incorporate ESG issues in valuation models.

For the case of sustainable (or less unsustainable) production, the focus is on two changes from the usual way that the company produces sugar: bioenergy production from sugarcane bagasse, a by-product of the production process; and the addition of a small line of organic sugar (less than 5% of the firm’s output).

For the case of bioenergy, assumptions regarding necessary investments and cash-flows are:

- CAPEX of U$ 200,000 in the first year and U$ 100,000 in years 2 and 3.

- Energy savings (the firm is not large enough to sell excess energy until year 5, but this would require more investments in connecting the company to the grid, which we disregard at this point) of U$ 15,000 beginning in year 2.

- Subsidized credit for the investment, reducing the firm’s total cost of capital by 0.2% a year (we assume 70% debt financing with subsidized loans by innovation programs from the Brazilian government – it is a generous assumption, as bioenergy projects can find 100% debt financing at very low costs by some Brazilian agencies like Finep, BNDES, and others). This is a particularly important point, which warrants a digression.Cost of capital and sustainability, a digression.

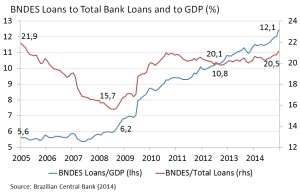

We will see later how most, if not all, of the value created by energy production is due to the reduction in WACC, which may seem like a strong assumption at first, or an idiosyncrasy of the Brazilian market. Interest rates in Brazil are notoriously opaque, as most industrial companies finance themselves with a mix of regular commercial banking debt, funds from BNDES (one of the largest development banks in the world, disbursing over U$ 100 billion per year), other agencies, bonds, and international markets. There are subsidies for investors who purchase corporate bonds from companies which invest in infrastructure projects, and all sorts of different subsidies. BNDES loans represent over 20% of total loans, and 12% of GDP in 2014.

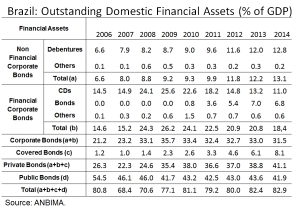

Compared to other countries, Brazil’s capital markets are relatively inefficient in providing funds for non-financial companies. Corporate bonds are relatively new and illiquid, and only surged in the last few years due to subsidies to investors.

Firms in Brazil are financially constrained, like in most of the developing world, which impacts investment and financing decisions. Cost of capital is high, but in most emerging countries there are different subsidized lines of credit, which are usually conditional on different industry-specific of firm-specific aspects. One such increasingly important aspect is the social responsibility and sustainability aspects of non-financial companies. In 2006, the Ministry of Environmental Protection, Peoples’ Bank of China, and China Banking Regulatory Commission developed a green credit policy, which was supposed to increase capital costs for heavily polluting industries and decrease it for more sustainable ones. Its major success story is the development of the Chinese solar industry (which received other subsidies as well, such as the Clean Development Mechanism), but there is no evidence that the cost of capital of heavily polluting industries actually fell. Even so, government-sponsored initiatives are at work, in China and other developing countries, albeit not necessarily devoid of green washing.

These examples from Brazil and China are relevant because companies in emerging markets that are financially constrained can use sustainability to leverage investments in sustainable practices. Such strategies can reduce the cost of capital in a much more significant way than we capture here, with a modest assumption of 0.2% reduction in the weighted average cost of capital.

The Sustainability Delta, an example

The idea behind the sustainability delta is to capture value-enhancing opportunities due to sustainability-based investments. Coming back to the valuation of the sugar manufacturing firm, with its current infrastructure, it can easily produce up to 5,000 pounds of organic sugar a year with minimal investments, a coverage rate of less than 1.5% of total production. The firm could choose a larger output, but that would involve distribution, marketing, and investment risks. Assuming no costs for introducing the product or additional marketing, a strong but realistic assumption given the distribution channels already in place, we assume the following measurable impacts:

- Prices for organic sugar are 20% higher than regular sugar.

- Sales in the local market, diversifying revenue streams (the company is mainly an exporter). Effect is not shown as cash flows in the valuation, but should be captured if one looks into risk management strategies.

- Production begins in year 2 and grows at the same rate as total production (total output stays the same over the period, and organic sugar production simply displaces regular sugar production).

The valuation, incorporating bioenergy and organic sugar, follows below. You can easily change the assumptions and see what happens if you want to fiddle with the original excel file.

The Sustainability Delta is the difference between the two valuations (around 2% of enterprise value). Most of the savings come from the reduction in WACC. We are not primed to believe that sustainability offers value-enhancing opportunities for companies, but the example should provide a path to incorporate sustainability-related investments into the cash flow profile of a non-financial company. Of course, the example of a sugar manufacturer is an easy one: a homogeneous product, well-defined production change, and the existence of a reduction of cost of capital opportunity. Even though reality is fuzzier than this simple example, there should be no major constraints to applying regular valuation techniques to deal with ESG risks and opportunities.

Commercial banks are trying to capture such opportunities, while impact investing is based on the idea that one can make money and present a positive social impact at the same time. Financial markets can become greener from the inside, but only if we bridge the gap between fiduciary duty and value-enhancing ESG investments.